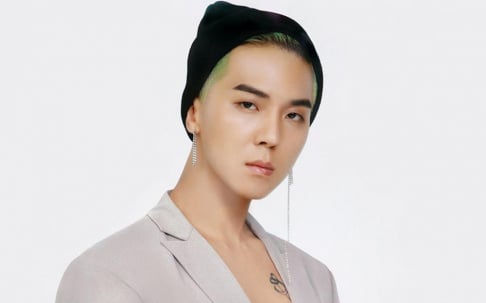

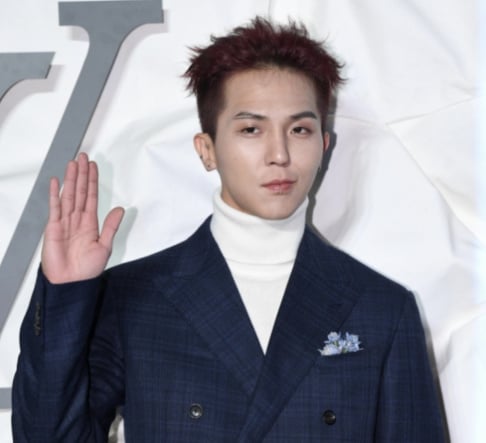

The netizen who claimed that Lieutenant Ken Rhee did not pay back the loan clarified the situation and stated he had received the exact amount of the loan back.

On October 6, the man stated on his social media, "The situation has ended and I have no hard feelings or hate towards him." as he stated that Lieutenant Ken Rhee paid back the loan in full.

First, the netizen stated, "I want to swear on my life to clearly explain since there is controversy over the amount of money I lent to Ken Rhee. I received the reimbursement in the amount stated in the ruling. He paid back the exact amount, not one penny less or one penny more."

The netizen claimed, "After meeting up with Ken Rhee and talking to him, I understood why he thought he had paid back everything. I'm satisfied with his apology and accepted his apology because I thought it was enough. At the time, I thought I had to get the money back no matter what so I used a not so good method. I also leaked his cellphone number in the process by accident so he's not the only one who did wrong."

The netizen also requested everyone to stop saying negative things. He stated, "I want everyone to stop saying bad things. I feel thankful that everyone is empathizing with me and being angry in my place. But I want everyone to stop now. I really don't have any bad feelings toward Ken Rhee. I hope everyone stops mentioning about this incident."

Previously, the netizen claimed that Ken Rhee borrowed 2 million KRW (~1,728 USD) from him in 2014 but did not pay back the loan.

SHARE

SHARE

When I urgently needed money, I turned to the site https://loans-online.co.ke/ . It offered a list of the best credit applications, and I quickly chose the right one. I was pleasantly surprised how fast and clear everything was. The process of applying and receiving money turned out to be easier than I thought. I recommend the site to anyone looking for easy and fast ways to get a loan.