Stock prices of Korea's leading entertainment agencies have all recovered.

According to the Korea Exchange on July 23rd, stock prices of the top four companies in the market, including JYP Entertainment, SM Entertainment, YG Entertainment, and Cube Entertainment, all rose. This is the result after comparing to the closing price of the stocks from March 19th to 22nd this year, when the KOSPI index hit its lowest point (1457.64).

During the period, JYP Entertainment's stock price jumped 93.35 percent from 16,550 KRW ($13.90) to 32,000 KRW ($26.88). SM Entertainment rose 63 percent and YG Entertainment also rose 96 percent. In particular, Cube, which actively purchased its shares and showed its willingness to boost its stock price, soared more than 200 percent from 1,450 KRW ($1.22) to 4,480 KRW ($3.76).

JYP has the largest market capitalization at 1.135 trillion KRW ($954 million) and is followed by SM Entertainment with 726.9 billion KRW ($610 million). YG Entertainment has a market capitalization of 698.1 billion KRW ($586 million), and Cube Entertainment's market cap is at 150.6 billion KRW ($126 million).

In the past, entertainment-related stocks have been criticized for being a flash in the pan investment destination that relies on popular celebrities rather than corporate soundness. The characteristics of industries with many variables such as poor accounting records and unstable profit structure also contributed to spreading negative perceptions.

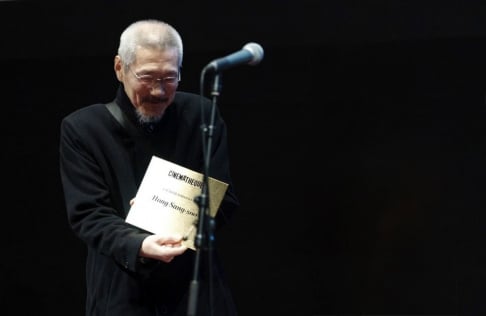

However, the "New Korean Wave" started to blow with the influx of idol groups over a few years. As interest in Korean pop music has increased globally and entertainment agencies have actively unveiled their financial structure and profits. Since then, agencies in the entertainment business have become the focus of attention. Entertainment company stocks have reached their heyday as they are expected to have the power to compete in advanced markets beyond Asia in countries such as the U.S. and Europe.

Among the top contributors to the rise in entertainment stock prices is the lifting of the Korean Culture ban in China, the comeback of artists in the entertainment companies, increased sales of albums, and the launch of new idol groups.

On the 30th of last month, it was reported that the Korea Tourism Organization joined hands with a large Chinese travel agency to promote Korean products. It is the first time that Korean tourism products have been officially sold throughout China since the government imposed a Korean Culture Ban in China following the THAAD deployment decision. Shares of JYP Entertainment and SM Entertainment jumped more than 10 percent in one day. Cube Entertainment and YG Entertainment also saw a slight increase of 6 percent.

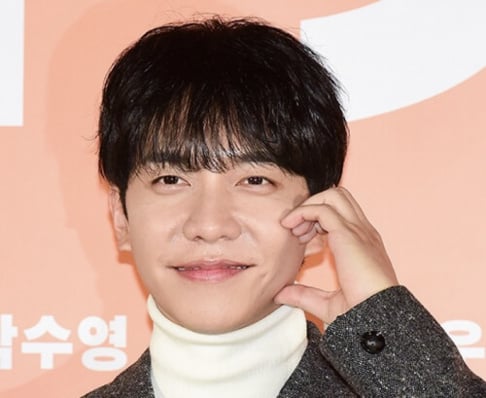

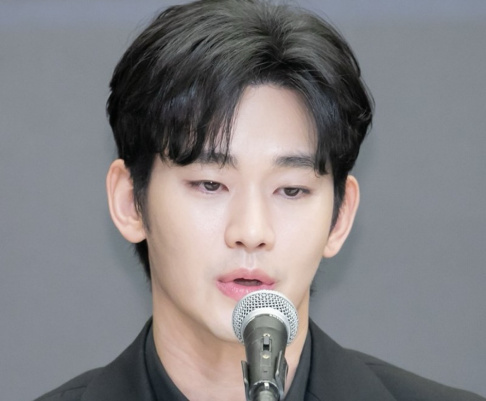

The comeback of artists representing each agency was also a catalyst to the increase in stocks. JYP Entertainment also launched a new idol group named "Niziu" after having successfully completed the promotion of their leading girl group TWICE. Niziu's digital album was released on June 30th and has reached the top of the Japanese charts. As a result, JYP's performance is likely to improve further. It has been confirmed that SM Entertainment also sold 2.3 million albums of their popular boy bands such as NCT127, NCT Dream, and also Baekhyun, a member of the group EXO. This is SM's largest album sales for a single quarter since the fourth quarter of 2018. Not only that, the comeback of Taemin and the debut of a new girl group for the first time in six years are also said to have a positive impact on the stock price of SM Entertainment.

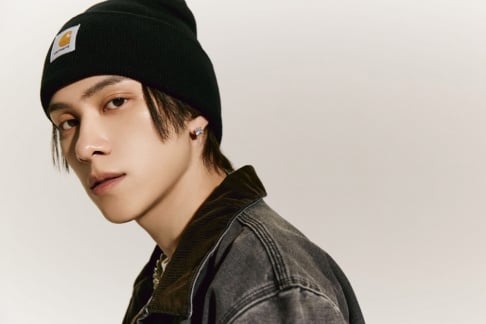

In the case of YG Entertainment, it was analyzed that the start of the promotion for the girl group BLACKPINK contributed to the rise in stock prices. YG Entertainment shares rose for the third consecutive day with BLACKPINK's comeback on the 26th of last month. Cube Entertainment announced the comeback of its artist, (G)I-DLE. The market is reportedly looking forward to the comeback of (G)I-DLE because of their popularity from the survival entertainment program 'Queendom'.

It is speculated that the entertainment company stocks will not cool off any time soon. Soon, the results of Big Hit Entertainment's preliminary screening request, one of the largest IPO's, will be announced. The number of shares issued by Big Hit Entertainment is expected to be 28 million shares.

As a result, the financial investment industry has raised the target stock price of entertainment companies. Lee Hyo Jin, a researcher at Meritz Securities, said, "Although there are no concert sales with Coronavirus outbreak, the performance will be good since the fandoms are concentrating on streaming the artists' album on the music streaming charts."

Lee Ki Hoon, a researcher at Hana Financial Investment, raised JYP's target share price by 24 percent, saying, "Group NiZiu's success has been confirmed." SM Entertainment's maintained its proper stock price based on investment opinion from the album sales performance. YG Entertainment's target stock price also rose 7 percent, citing global album sales of its girl group BLACKPINK and its achievement in achieving 100 million views in the shortest time in YouTube history.

Kim Hyun Yong, a researcher at EBEST Investment & Securities, also stated, "It will be possible have a surplus in sales as BLACKPINK's album will be released in September and will have a solid performance in sales." Lee Nam Soo, a researcher at Kiwoom Securities, also raised SM Entertainment's target stock price to 42,000 KRW from 33,500 KRW.

SHARE

SHARE

Yeah jyp..ps: *whisper😎