|

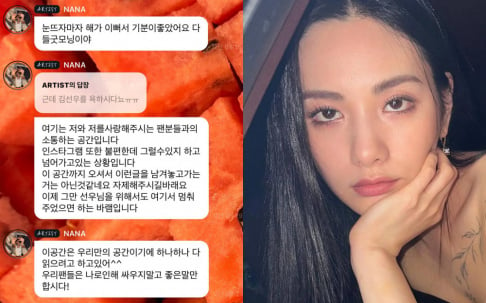

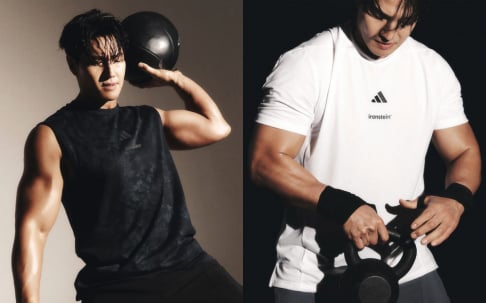

| SM Entertainment founder Lee Soo-man |

By Jhoo Dong-chan

KB Asset Management sent an open letter to SM Entertainment demanding better corporate governance and dividend payouts, the company said Thursday.

Owning a 7.59 percent stake, KB Financial Group's asset management unit is the third-largest shareholder of the nation's largest entertainment agency.

"SM Entertainment is paying Like Agency about 46 percent worth of the agency's entire operating profit every year," KB Asset Management said in the letter.

"Like Agency is another entertainment agency owned entirely by SM Entertainment founder Lee Soo-man. Such a practice clashes with the interests of SM Entertainment's shareholders. This could develop into a social issue, or a legal battle with shareholders in the worst case."

The asset management firm also demanded an immediate merger between SM Entertainment and Like Agency while paying a 30 percent dividend payout ratio.

According to SM's business report, Like Agency has provided a producing and consulting service for SM Entertainment performers over the past 10 years. SM paid Like Agency 14.5 billion won ($12.3 million) last year and 10.8 billion won in 2017.

Apart from its issue with Like Agency, SM Entertainment has never paid dividends since the agency went public in 2000.

"SM Entertainment suffered a great deal of losses in its new winery and restaurant business. These businesses are entirely irrelevant to SM's original entertainment agency business," KB Asset Management added.

"SM Entertainment is now considered to be suffering from a lack of internal control in its corporate governance. We will nominate a new outside director during the next general shareholders' meeting to strengthen monitoring the firm's board and its decision-making process."

SM Entertainment denied the allegations claiming its deal with Like Agency was transparent, but implied it would pay dividends.

"We will review our options to better accommodate our shareholders' rights," the agency said.

KB Asset Management announced May 31 it owned a 7.59 percent stake in SM Entertainment. Lee and his affiliates are the agency's largest shareholder with a 19.49 percent stake.

Owning an 8.18 percent stake, the National Pension Service is SM's second-largest shareholder. Korea Investment Value Asset Management is the fourth-largest one owning a 5.13 percent stake in the agency.

SHARE

SHARE

The way it's written it doesn't look illegal. It looks like Lee Soo-man took an approach to retain ownership in a way it wouldn't affect his personal assets. He created a company that would be the major stockholder of the now publicly traded corporation that he created.

I wonder if they'll make the audit findings public. If he did something shady, I'm sure they will. But what I'd like to see is 𝘪𝘧 and how Like Agency reinvested in SM

-- since no other shareholders profited (is this correct?).