On November 15, the "SM Stock Price Manipulation" trial at the Seoul Southern District Court stalled when Kim Ki Hong, former CFO of Kakao, who was expected to appear as a witness, failed to show up.

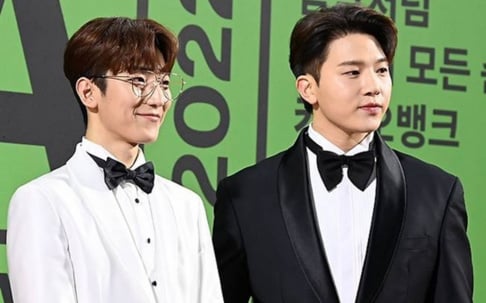

This trial was particularly significant as it marked the first court appearance for Kim Beom Soo, Kakao’s founder and Chairman, since his release on bail. The case has drawn substantial public interest, with numerous media members filling the courtroom. However, after an hour of waiting with only the defendant and attorneys present, the session ended anticlimactically.

While witness no-shows are not uncommon, this instance raised eyebrows. When the subpoena could not be delivered due to a “closed and unoccupied premises” status, the prosecution contacted the defense by phone. Yet, Kim Ki Hong’s lawyer submitted a brief statement on his behalf, citing “personal reasons” for his absence. Consequently, the court issued a warrant for his appearance on the day of the trial.

In criminal cases, calling witnesses is the prosecution's duty to substantiate charges. Kim Ki Hong, seen as a pivotal witness, was crucial to the prosecution’s argument. Losing a court date due to a unilateral witness absence was thus especially disappointing. The defense, worried about further delays, proposed reordering the witness list, but the prosecution declined, leading to tension. The judge raised his voice, urging the prosecution, "Please ensure the subpoena delivery process runs smoothly for the next trial date."

Prosecutors allege that Kim Beom Soo was involved in manipulating SM Entertainment's stock following a four-day buying spree of shares. The purchases were reportedly aimed at inflating the company's market valuation, making it unreachable for rival bidder HYBE to buy SM.

The case has already been in the first-trial stage for over a year, with a change of judges and additional defendants added along the way. Kim Beom Soo was indicted in August, and his case was merged with the current one earlier this month, effectively restarting the proceedings. Over the past year, the trial has seen many irregularities. The investigation dragged on, and the "conclusive evidence" the prosecution had confidently claimed is still unconfirmed.

The case began on February 27 of last year, when HYBE filed a formal complaint with the Financial Supervisory Service (FSS). The FSS acted remarkably quickly, issuing an investigation report within about ten days—a much swifter response than is typical for other complaints. The FSS released a major press statement, and Kim Beom Soo faced the public humiliation of standing on the “financial authority photo line.”

However, once in court, the prosecution seemed more focused on tactical maneuvers, such as witness sequencing, rather than presenting substantial evidence, causing delays. Some in the business community have openly questioned whether there might be ulterior motives behind the intense investigation of Kakao and Kim Beom Soo.

SHARE

SHARE