On February 17 KST, 'Dispatch' accused Lee Soo Man of embezzlement, manipulation, and unethical profiting.

In 1999, SM Entertainment began preparations for its IPO (initial public offering) on KOSDAQ. However, at the time, the requirement for a company going public was to own over 1 billion KRW (~ $800,000 USD) in capital. SM Entertainment could not meet this requirement, owning a mere 50 million KRW.

Lee Soo Man thus drew up a plan to increase capital by issuing new stocks. He took approximately 900 million KRW from SM Entertainment's funds, and approximately 250 million KRW from SM Enterprise. This money was used to pay for new stocks, thus "increasing" the capital owned by SM Entertainment with its own funds.

In March of 2000, Lee Soo Man owned 66.99% of SM Entertainment's stocks. His father owned 4%, his mother owned 3.3%. In April of 2000, SM Entertainment made its public offering. By June of 2000, SM Entertainment had a market cap of 180 billion KRW (~ $139 million USD). In just one year, Lee Soo Man took 1.15 billion KRW (~ $888,000 USD) of SM Entertainment's funds and transformed it into about 90 billion KRW (~ $70 million USD).

In January of 2003, Lee Soo Man was listed as a wanted criminal on Interpol. In May of the same year, Lee Soo Man was tried and found guilty of embezzlement, receiving 2 years in prison, deferred by a probationary period of 3 years.

During the trial, the court concluded, "Lee Soo Man embezzled 1.15 billion KRW in his company's funds and used it to acquire stocks. With no evidence of any real capital, Lee Soo Man used fake capital to purchase stocks and pretended as if the company's capital had increased. Due to the seriousness of this crime, the defendant must face punishment." Lee Soo Man's legal representative attempted to defend the producer by claiming that the decision to invest company funds in new stocks was agreed upon by the board of directors, and that Lee Soo Man directly returned the borrowed funds.

However, in an interview with 'Dispatch' on February 17 KST, a former director of SM Entertainment confirmed, "He used fake capital to pay for stocks so the company could go public. There was no agreement from the board of directors because there was no board meeting to discuss this matter. A record of the meeting's numbers were drawn up afterward as a matter of procedure by the legal team. Lee Soo Man was behind it all. He only returned the borrowed funds after the police investigation began."

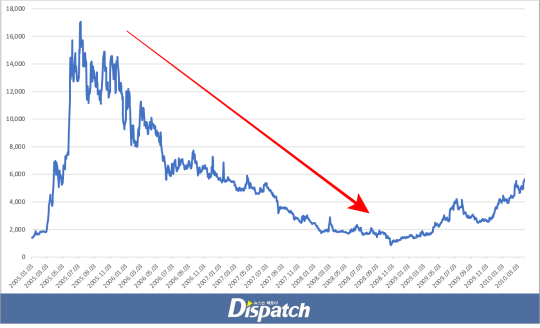

Meanwhile, in 2001, Lee Soo Man sold approximately 1 billion KRW of his stocks. The same year, his mother also sold approximately the same amount in stocks. In 2005, Lee Soo Man's father sold all of his stocks in SM Entertainment, worth approximately 5.4 billion KRW (~ $4.2 million USD). Lee Soo Man also sold a portion of his stocks for approximately 10.5 billion KRW (~ $8.1 million USD). Afterward, Lee Soo Man still possessed 43.87% of SM Entertainment's total stocks.

In similar fashion, Lee Soo Man continued to gain riches by selling his stocks each time SM Entertainment's stock value peaked. From 2002 through 2005, Lee Soo Man made 10.6 billion KRW through the sale of his stocks. Soon afterward, SM Entertainment initiated a capital increase by allocating new stocks to its shareholders, which meant that Lee Soo Man would gain back up to as many shares as he sold. In the same way, Lee Soo Man again earned 7.8 billion KRW by selling stocks in 2010, then earned 17.7 billion KRW in 2012.

Finally, after a series of stock sales and acquisitions (via SM-initiated capital increase), Lee Soo Man would engage in one final stock trade in 2023. For the first time in the history of SM Entertainment, Lee Soo Man is no longer the largest shareholder. The producer recently sold 14.5% of SM Entertainment's shared to HYBE, being paid 422.8 billion KRW in the process.

Meanwhile, outside of stock trading, Lee Soo Man continued to gain riches from SM Entertainment's profits through two companies housed under SME, SM Enterprise and LIKE Holdings.

SM Enterprise, described as a company which "fulfills managerial duties for SM Entertainment artists", received 20% of all SM Entertainment music sales each year. LIKE Holdings, described as a company which provides "music consultation and production services", received 15% of all SM Entertainment music sales each year. Both companies specifically received a percentage of SM Entertainment's sales, not operating profits.

On top of that, Lee Soo Man served as a director of SM Entertainment, which means he received an annual salary.

SM Enterprise was incorporated into SM Entertainment in 2002. However, LIKE Holdings continued to operate as a private company until 2022. Through the private company, it's believed that Lee Soo Man earned 174.1 billion KRW (~ $135 million USD) in producing fees alone.

Furthermore, it was recently revealed that Lee Soo Man profits in a similar manner in foreign music distribution and sales, through the company CT Planning Limited, termed "LIKE Holdings #2".

Meanwhile, SM Entertainment itself experienced a roller coaster in sales and profits throughout its lifetime. From 2002~2004, the company recorded deficits. In 2005, the company entered positive figures in sales and profits, only to record deficits again from 2006~2008. But even when SM Entertainment recorded minus operating profits, Lee Soo Man continued to pocket significant amounts of earnings for himself.

'Dispatch' alleges that Lee Soo Man has earned over 744.3 billion KRW (~ $570 million USD) in the past 23 years since SM Entertainment first made its public offering. But in 2021, SM Entertainment recorded an annual operating profit of 74 billion KRW, even when sales peaked at 417 billion KRW. Lee Soo Man was paid 24 billion KRW in producing fees alone that year.

In the end, 'Dispatch' claimed that it was time for SM Entertainment to come under proper management, free of Lee Soo Man's greed, but also free of the same executive board who "knowingly watched as Lee Soo Man manipulated various internal affairs as he pleased".

SHARE

SHARE

SM will probably be better w/o LSM and his family.

10 more replies