K-beauty brands are increasingly turning to male K-pop idols as the faces of their global campaigns, moving away from the traditional choice of female models in a calculated effort to appeal to their main consumer base — women. This reverse-marketing approach, driven by the massive international popularity of male idol groups, is yielding remarkable results in both brand recognition and overseas sales.

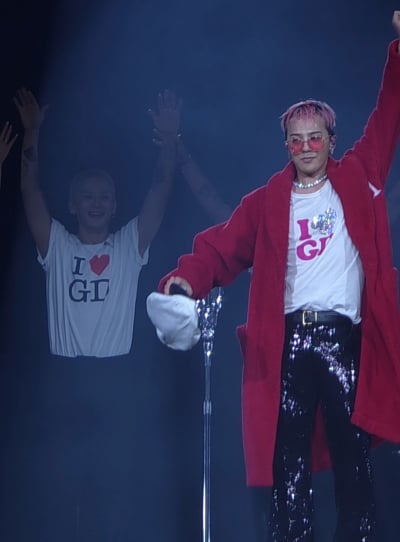

Amorepacific recently made headlines when its makeup brand Hera appointed Felix of Stray Kids as global brand ambassador, the first time the brand has ever chosen a male star for its lead role. Hera’s previous representative, Jennie of BLACKPINK, held the position for six years starting in 2019. Industry observers note that choosing a male idol with strong appeal among Western female fans can rapidly raise a brand’s international profile. The move follows the company’s earlier success with its skincare brand Laneige, which named Jin of BTS as its model last year. Amorepacific reported that after Jin’s appointment, Laneige’s overall sales in the fourth quarter of 2024 surged more than 30% compared to the same period the previous year. Sales rose across major channels including Sephora and Amazon, and Laneige climbed to the No. 3 skincare brand in sales at Sephora during that period.

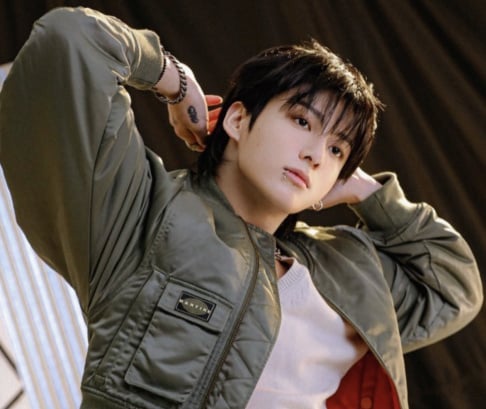

Independent and smaller K-beauty brands are adopting the same strategy. In February 2025, A’pieu, a color cosmetics line under Able C&C, signed Jeno of NCT as its brand ambassador. The brand saw a 357% year-over-year jump in search volume on social media following the release of his first pictorial in June. A company representative explained that Jeno’s strong popularity among overseas Gen Z women was a key factor in his selection. Around the same time, Mixsoon, a skincare brand by Fakket, named boy group ENHYPEN as its global ambassadors, and Isntree brought on Jaemin of NCT as a model.

Brands are also tying endorsements to limited-edition fan merchandise and events to maximize impact. Dr.G, a skincare label under Gowoonseang Cosmetics, is currently offering customers who purchase its 70mL soothing cream at Olive Young through Aug. 10 the chance to enter a fan signing event with their global ambassadors, boy group BOYNEXTDOOR. A spokesperson for Olive Young noted that more cosmetics companies are offering perks such as photo cards and fan meeting entries alongside product purchases, especially when male idols are fronting the campaigns.

Experts say the choice of model can significantly influence a brand’s growth in overseas markets. Lee Young Ae, a professor of Consumer Studies at Incheon National University, observed that because women are the primary buyers of cosmetics, featuring male idol groups can be an especially effective way to boost international brand recognition in a short time.

The marketing push is helping drive strong export performance. Data from Aicel shows that in July 2025, Korea’s provisional cosmetics exports totaled about USD 935 million, up 17.1% from the same month last year. Sales to France and the UK rose sharply by 70.4% and 22.8% respectively, while exports to the Middle East jumped 38.8%. With product quality and aggressive promotion working hand in hand, the influence of male idols in K-beauty campaigns appears set to grow even stronger.

SHARE

SHARE