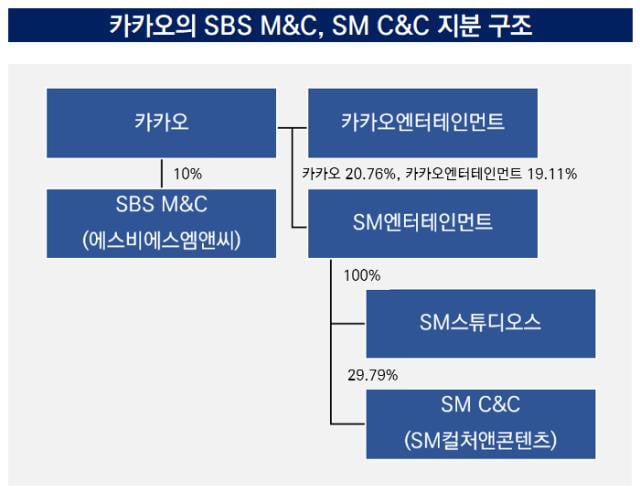

The Korea Communications Commission has determined that Kakao has violated regulation by acquiring SM C&C, a multi-industry business operating in content and advertisement production, entertainment management, travel and tourism, etc.

The issue comes from the fact that Kakao is already the largest shareholder of the media rep firm SBS M&C, a privately managed firm providing integrated marketing services through the broadcasting station SBS. According to the KCC, an advertisement business representing specific affiliates in the industry cannot possess shares of a media rep, based on article 13, paragraph 6 of the Act on Broadcast Advertising Sales. SM C&C, a subsidiary of SM Entertainment, falls into the category of "an advertising business representing specific affiliates".

On July 5 KST, the KCC held an advisory board meeting and concluded that Kakao must respond to this violation in the next 6 months.

Previously, Kakao acquired SM Entertainment through a public takeover bid at the end of March. Kakao currently owns 20.76%, and Kakao Entertainment owns 19.11% of SM Entertainment's total shares. SM Entertainment currently owns 29.79% of SM C&C's total shares, while Kakao owns 10% of SBS M&C's total shares.

In order to resolve the violation pointed out by the KCC, Kakao must dispose of either SBS M&C or SM C&C in the next 6 months. This aligns with SM Entertainment CEO Jang Cheol Hyuk's 'SM 3.0' plan, which previously announced the company's intentions to sell non-core assets in order to focus on company growth. However, due to a decline in SM C&C's market cap in 2023 (228.1 billion KRW), it remains to be seen if Kakao and SM Entertainment will be able to sell the "non-core" subsidiary at fair value.

SHARE

SHARE

Squirreltoo (Banned)9,061 pts Thursday, July 13, 2023 0Is this what they call a monopoly on the market?