The ongoing feud between ADOR CEO Min Hee Jin and HYBE is taking a toll on shareholders, with HYBE's stock price dropping below the 200,000 won mark. On May 13, HYBE's stock price plummeted by 7,700 won, reaching the 190,000 won range. This decline marks a significant drop from the nearly 240,000 won seen just 20 days prior.

As the conflict between CEO Min Hee Jin and HYBE unfolds, shareholders are left to contend with the direct consequences of the stock price decline. Discussions in online HYBE stock forums reflect concerns about the future trajectory of the stock, with some expressing apprehension about further declines and speculating about a potential drop to 100,000 won.

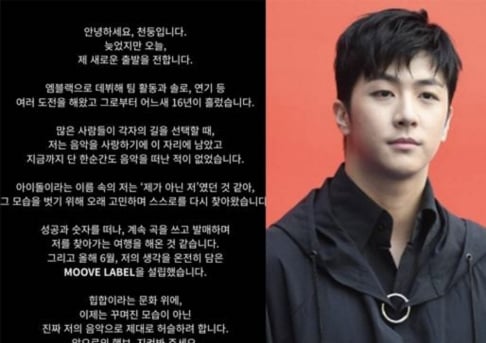

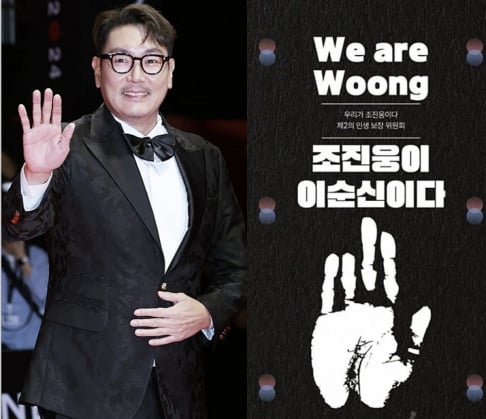

An extraordinary shareholders' meeting is scheduled for May 31 to decide whether to oust Min Hee Jin, who has been at odds with HYBE. ADOR recently announced that they convened a board meeting on May 10, attended by all members, including HYBE's auditor, and agreed to hold an extraordinary general meeting of shareholders. The meeting's agenda, based on HYBE's request, primarily focuses on the dismissal and appointment of directors, with a focus on removing Min Hee Jin as CEO.

HYBE initiated a surprise audit of ADOR last month, citing suspicions of management rights theft. The current ADOR board, dominated by Min Hee Jin and his close associates, is under scrutiny, with HYBE pushing for the replacement of current executives.

The outcome of ADOR's management overhaul hinges on the result of Min Hee Jin's application for a temporary injunction to prevent HYBE from exercising its voting rights at the extraordinary shareholders' meeting. If the court grants the preliminary injunction, it could disrupt HYBE's plans and prolong the situation.

The ongoing battle between HYBE and Min Hee Jin, characterized by disputes over group concepts and management strategies, is set to continue amid a packed schedule of board meetings, shareholder gatherings, and legal proceedings.

SEE ALSO: Court freezes Bang Si Hyuk's 100 million USD assets in HYBE Labels ahead of his indictment

SHARE

SHARE

Following the controversial actions of HYBE, South Korean critics and financial advisors pointed out BSH's biggest mistake which was the way he set up his multilabel system

4 more replies