Korean entertainment giants braced a challenging year in 2024, as sluggish album sales and the absence of megastars and their intellectual properties (IPs) like BTS and BLACKPINK in their complete lineups weigh on their financial performance. However, analysts predict a rebound in the latter half of 2025, with major artists returning to the stage.

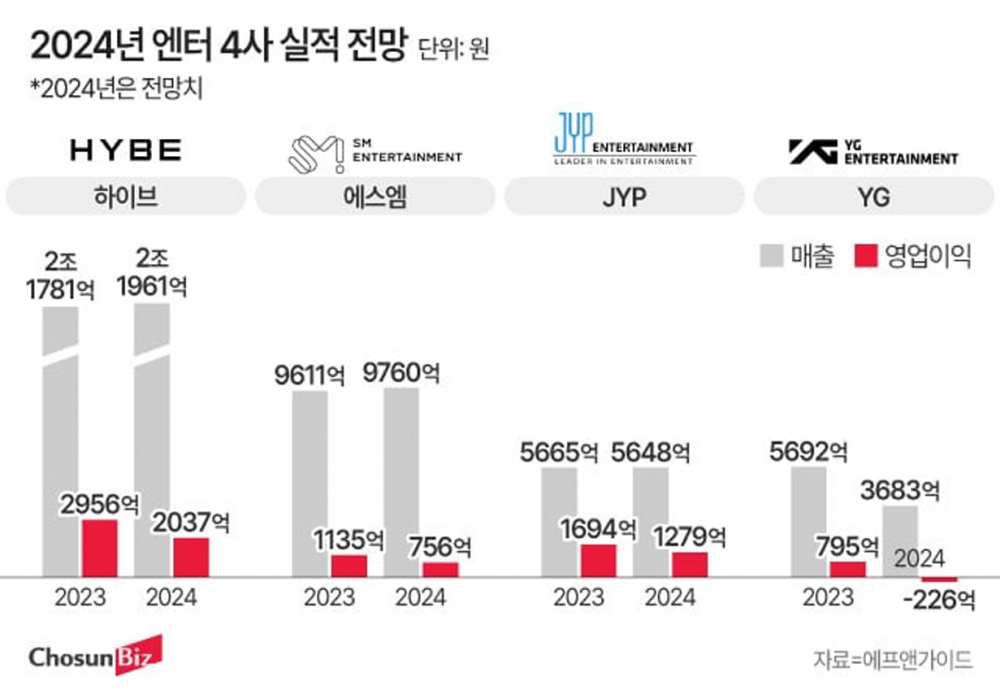

The financial data company FN Guide released its 2024 financial projections for the Big 4 companies on January 21. HYBE, which surpassed 2 trillion KRW (~1.4 billion USD) in revenue for the first time in 2023, is expected to set a new record with projected 2024 revenue of 2.196 trillion KRW (~1.5 billion USD), a 0.8% year-on-year increase. However, operating profit is estimated to decline by 31% to 203.7 billion KRW (~141.9 million USD) in 2024 from 295.6 billion KRW (~205.9 million USD) in 2023.

Similarly, SM Entertainment’s revenue is forecasted to grow 1.6% to 976 billion KRW (~680 million USD), but its operating profit is expected to drop by 33.4% to 75.6 billion KRW (~52.7 million USD). JYP Entertainment, while less impacted, is projected to see flat revenue at 564.8 billion KRW (~393.4 million USD) and a 24.5% decline in operating profit to 127.9 billion KRW (~89.1 million USD).

YG Entertainment is predicted to post the weakest performance among the major companies. Its revenue is expected to drop from 569.2 billion KRW (~396.5 million USD) in 2023 to 368.3 billion KRW (~256.6 million USD) in 2024, with an operating loss of 22.6 billion KRW (~15.7 million USD), returning to pre-2022 levels.

A significant factor in the entertainment sector’s struggles is weak album sales. Stricter regulations in China limiting fan-driven fundraising for celebrities have reduced bulk album purchases by K-pop fans. Additionally, internal conflicts, such as the prolonged dispute between HYBE executives and former ADOR CEO Min Hee Jin over NewJeans, have reportedly affected album marketing strategies.

According to Circle Chart, physical album sales in 2024 fell 17.7% year-on-year to 98.9 million copies from 120.2 million in 2023. Seventeen’s cumulative album sales, for instance, dropped from 16 million in 2023 to 8.96 million copies in 2024. The number of groups selling over 3 million copies fell from 11 to 7, and no group had an album exceeding 5 million sales.

The push to discover the next generation of K-pop stars has also strained profitability, with increased investments in rookie groups. YG debuted the multinational girl group BABYMONSTER, while SM launched the UK boy group dearALICE. HYBE introduced a U.S.-based localized K-pop group, KATSEYE, through its K-pop production system. These efforts resulted in higher upfront costs.

Experts anticipate improvement in 2025’s latter half as BTS and BLACKPINK’s full group activities are scheduled to resume. Additionally, rookie groups such as HYBE’s ILLIT, Pledis Entertainment’s TWS, and SM’s NCT WISH are expected to start generating revenue. Analysts forecast combined revenue for the four major entertainment companies to grow by 16.4% year-on-year to 4.8 trillion KRW (~3.34 billion USD) in 2025, with operating profit increasing by 60.6% to 661.3 billion KRW (~460.1 million USD).

Among the four companies, YG Entertainment is the only one expected to post a deficit in 2024. In response, YG announced it would end its actor management business, allowing its 24 actors to leave upon contract expiration. Additionally, YG sold a 60% stake in drama production company Studio Plex in 2022 and dissolved its dance management label YGX. YG plans to use this restructuring as a foundation for reinforcing its leadership in the music industry in 2025.

Experts stress that K-pop must consistently introduce groundbreaking artists to ensure long-term growth. Lee Jang Woo, a professor of business at Kyungpook National University, stated, “The cost of discovering and promoting new talent is rising, while the seven-year limit on standard contracts makes it harder to recoup on their investments.” He added, “BTS emerged from HYBE when it was a small agency. Regulatory reforms and incentives are needed to enable smaller companies to create innovative artists.”

SEE ALSO: Staff Picks: Our Favorite Songs of 2025

SHARE

SHARE