Individual investors inBig Hit Labels' prices are finding themselves with a big loss in their investment.

The IPO price for Big Hit Entertainment was 135,000 KRW. On the first day, the stock traded for 270,000, but ended up trading at 258,000 KRW at the close of business day. On the second day, values fell even more to 205,000 KRW, which is a 22.29% drop. This is unsurprising, as investors who are sophisticated sell whatever shares that are not locked in for them at the high price of the IPO. They sold almost 3.1 billion KRW worth of shares to individual investors, who bought them at 4.04 billion KRW. However, in the process, the stock further dropped and private investors saw an loss averaging of 24%.

Because initial institutional investors are locked into their stock for a month, it is predicted to drop even further - as stocks always do once the locked in shares are released, as it puts more shares on the market. Institutional investors have 35.7% of the shares currently, and after their period is over in a month, about 15% of the total shares are expected to come onto the market, further decreasing the prices.

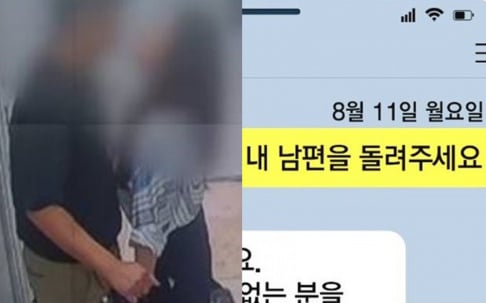

While this is the standard process for IPO stocks, many new investors - such as individual ARMYs who jumped into the market without much knowledge - are suffering from the drop in price. There are even some posts asking if they can get 'refunds' on stock.

SHARE

SHARE

I don't know why people is this surprise... Before the company start with the IPO process, specialist said they were worried because the prices of the stocks were higher than the actual worth of the company.

People bought actions because of BTS popularity... That's the reality behind that. When the real price is stablish, it will probably be much less. Even if they will be the biggest entertaiment company, but still not as much as is in paper right now.

4 more replies