Circle Chart (formerly Gaon) recently released an article, reviewing K-pop's physical album sales numbers for the first half of 2024. This year's first half saw a decrease of approximately 8.2 million copies (-14.9%) in physical album sales compared to the same period last year, leading to concerns that the K-pop market may have already peaked.

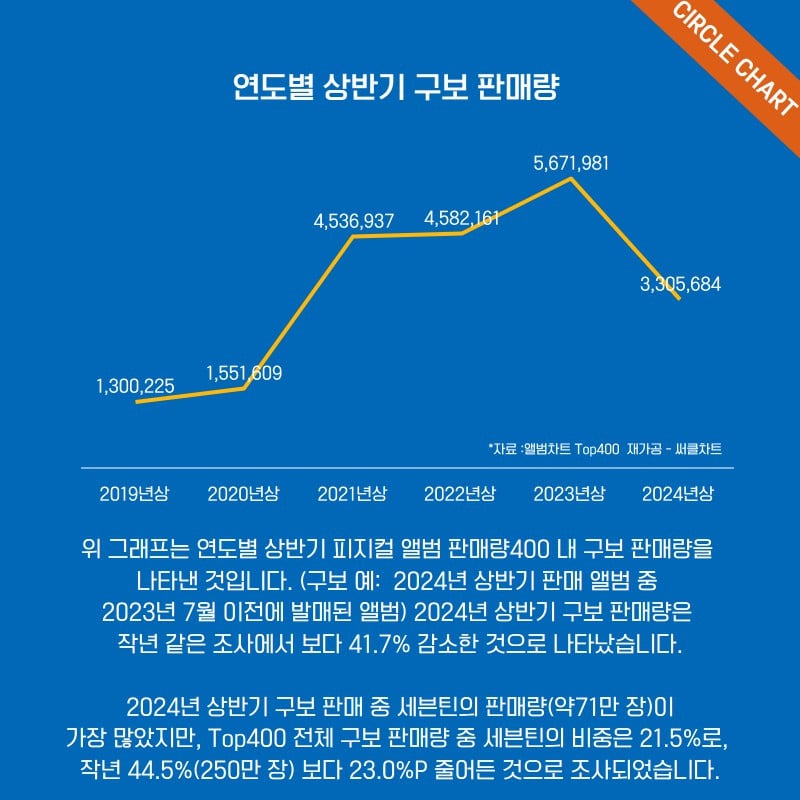

This chart illustrates the sales of older albums (released before the current year) from 2019 to 2024. In the first half of 2023, older K-pop albums sold 5,671,981 copies, but in the first half of 2024, sales declined to 3,305,684 copies, a drop of 41.7%.

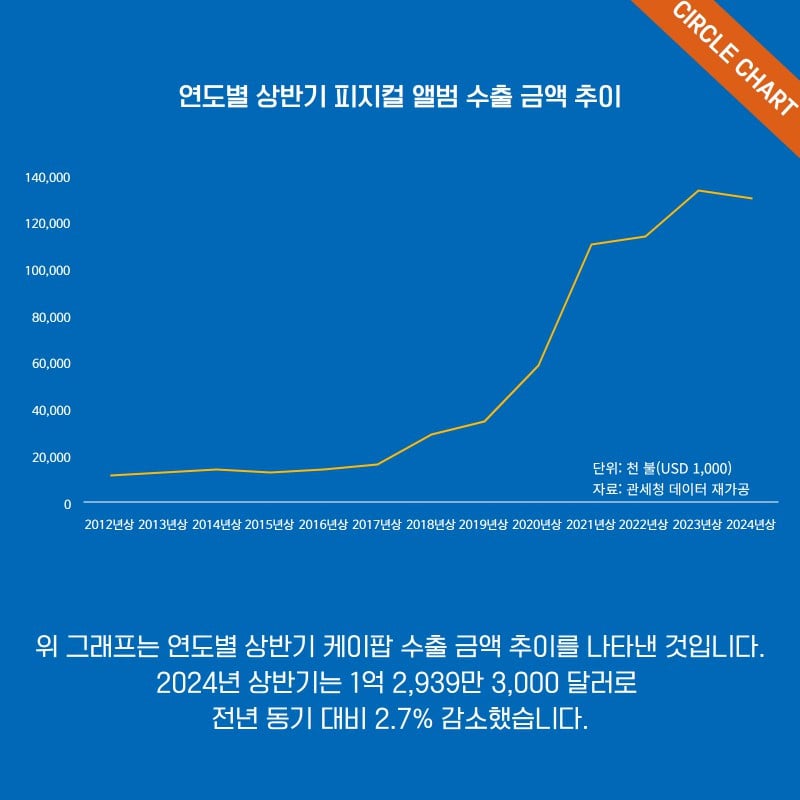

This graph reveals that the export sales for old K-pop albums in the first half of 2024 was around 130 million USD, which is a drop of 2.7% compared to the same period last year.

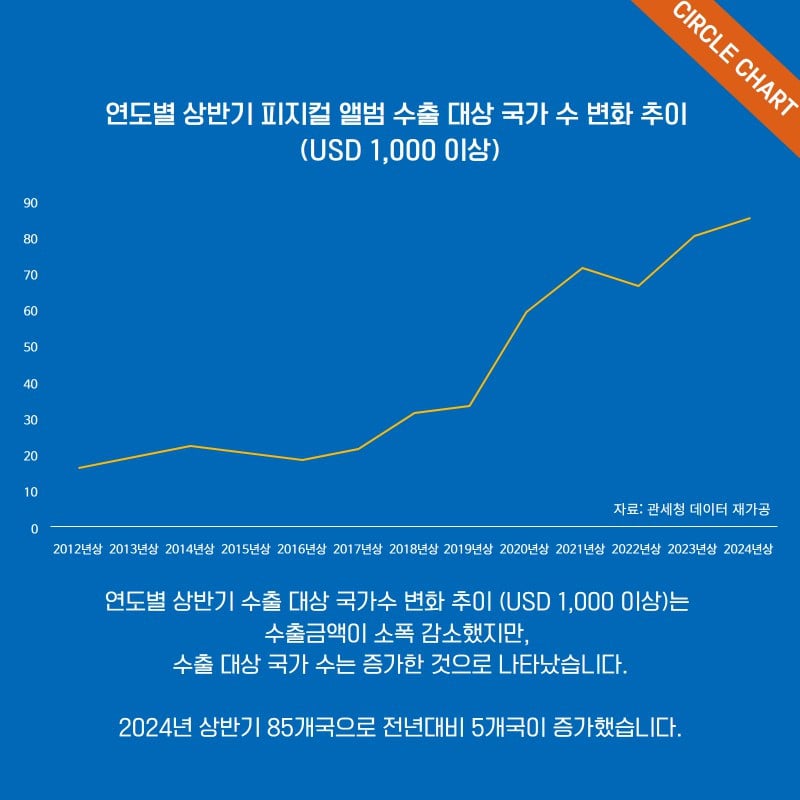

Although sales numbers have decreased, more countries are importing K-pop albums. In first half of 2024, 85 countries imported K-pop albums which is an increase of 5 countries compared to the same period in 2023.

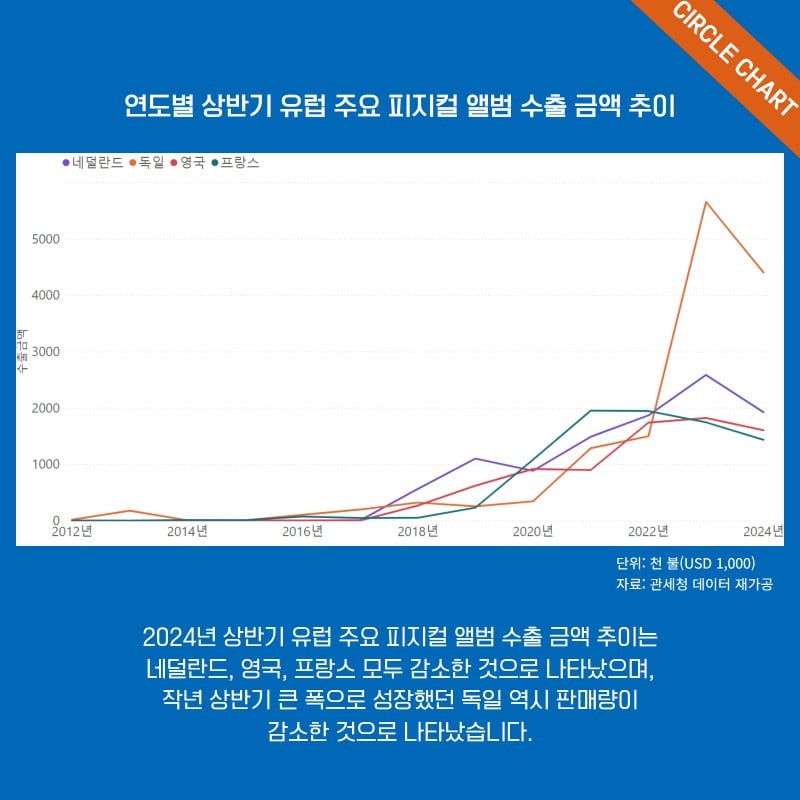

In Europe, K-pop album sales decreased in The Netherlands (Purple Line), Germany (Orange Line), The UK (Red Line), and France (Green Line) in the first half of 2024 compared to the same period of 2023.

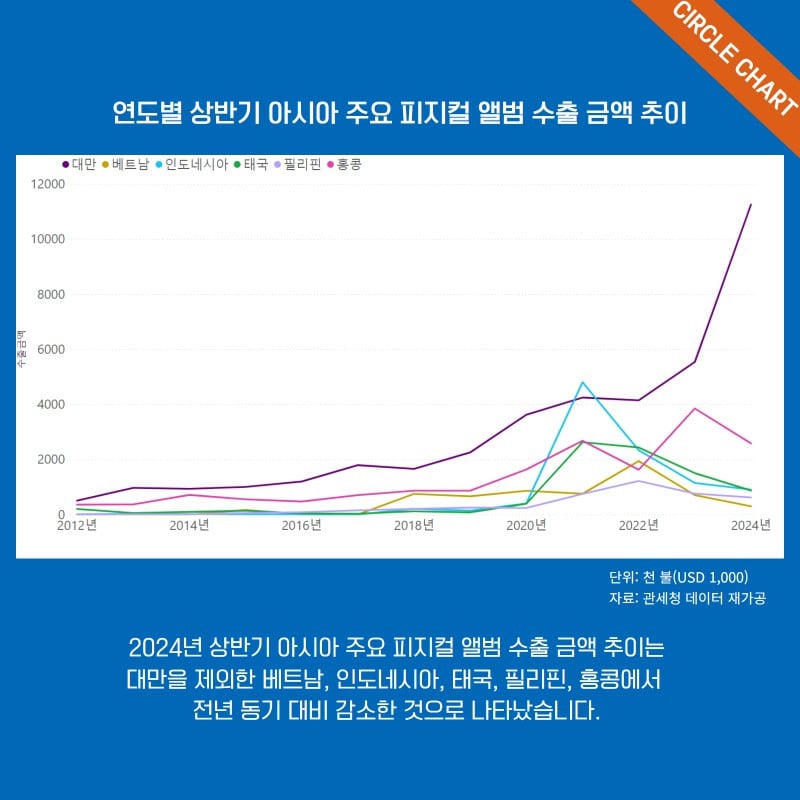

In Southeast Asia, K-pop album sales decreased in Vietnam (Yellow Line), Indonesia (Blue Line), Thailand (Green Line), the Philippines (Lavender Line), and Hong Kong (Pink Line)in the first half of 2024 compared to the same period of 2023. However, Taiwan (Purple Line) saw a huge increase, nearly doubling the K-pop album sales in the first half of 2024 compared to the same period last year.

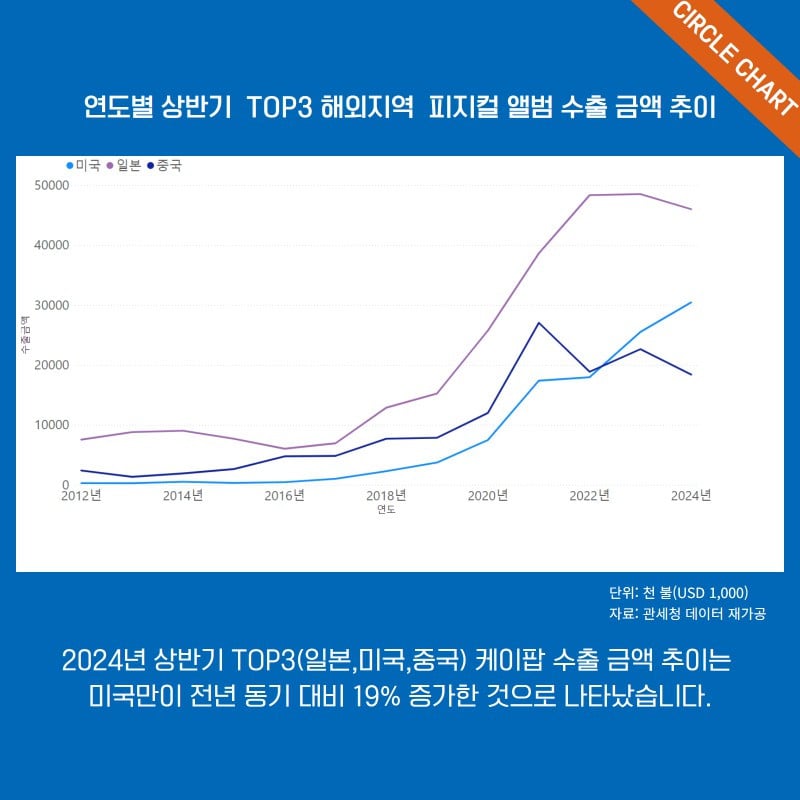

The above chart shows the top 3 overseas markets for K-pop album sales. Japan (Purple Line) and China (Navy Line) showed slight decreases in K-pop album sales in the first half of 2024 compared to the same period of 2023. However, the United States (Blue Line) saw a large increase.

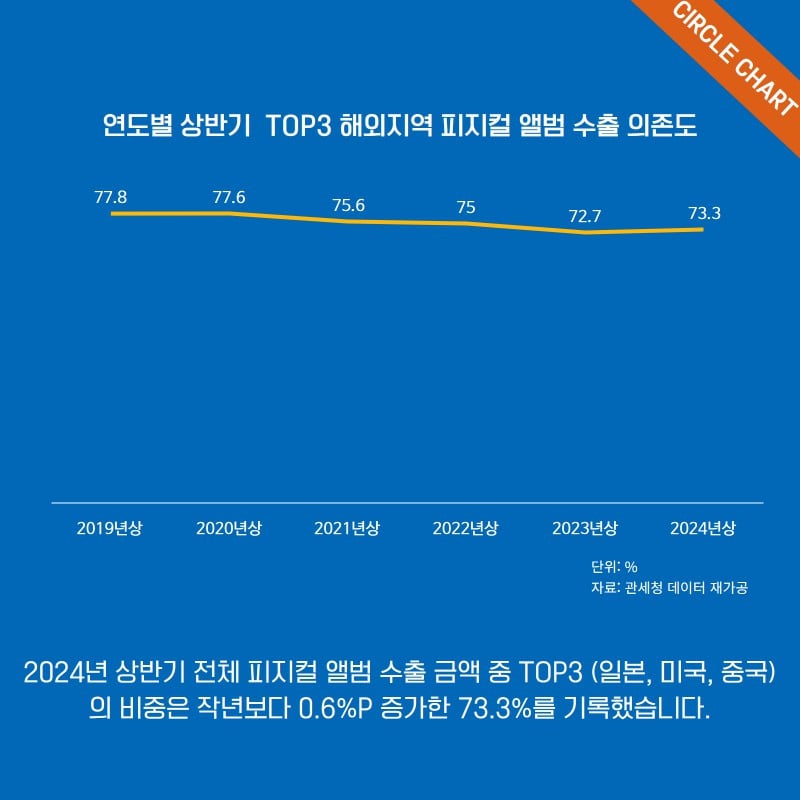

The above chart reveals the top 3 overseas markets for K-pop albums (Japan, the United States, and China) accounted for 73.3% of the total overseas market in the first half of 2024, a slight increase compared to the 72.7% in the same period last year.

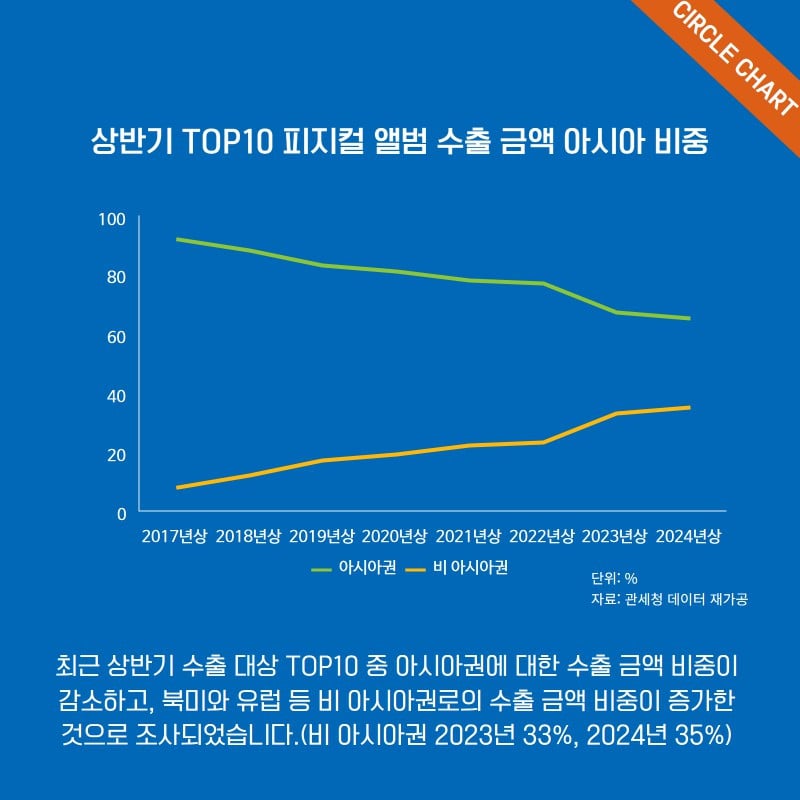

The proportion of K-pop album sales in Asia (Green Line) is decreasing, while markets outside of Asia (Yellow Line) are increasing (mainly in North America and Europe). The Asian market accounted for 67% of K-pop album sales in the first half of 2023 while outside Asia was at 33%. In the first half of 2024, the Asian market accounted for 65% of K-pop album sales, while outside of Asia, it was at 35%. Compare this to 2017, when over 90% of K-pop album sales were from the Asian market and less than 10% from outside the Asian market.

Kim Jin-woo, a senior researcher at Circle Chart, concluded that in the first half of 2024, the export value of K-pop physical albums dropped by 2.7% compared to the same period last year. Additionally, sales of the top 400 albums on the Circle Chart fell by 14.9%. Older album sales volume also decreased by 41.7%, suggesting that the long-lasting growth of the K-pop album market is slowing down. This decline in both overall and older album sales indicates that the influx of new fans into the K-pop market has slowed as well.

In the first half of this year, the trend of a decreasing share of exports to Asia among the Top 10 overseas markets and an increasing share to North America and Europe continued. Most regions, except for the U.S. and Taiwan, saw a decline in sales compared to last year. However, despite the drop in exports, the number of countries importing K-pop albums slightly increased.

In addition to the album market slowing down in part due to the revival of live performances after COVID-19, there seems to be a lack of clear top-tier K-pop successors to BTS and BLACKPINK, who have long dominated the K-pop market. This absence of new leading artists is another reason for the slowdown in album market growth. The K-pop industry now needs new growth drivers to move to the next stage.

SEE ALSO: SAY MY NAME wins with “UFO” + Powerful performance on January 9th’s ‘Music Bank’!

SHARE

SHARE