Kakao has announced a strategic decision to sell the majority of its subsidiaries, excluding some key assets, in a bid to address mounting legal challenges and negative public opinion. The company’s founder, Kim Beom-su, who serves as the chairman of the Kakao Management Reform Committee, is under investigation for stock manipulation with the prosecution requesting an arrest warrant, exacerbating the company’s legal woes. This move aims to improve corporate governance and streamline operations.

• Kakao to Sell Most Subsidiaries: The company plans to divest most of its subsidiaries, including Kakao Games, Kakao Entertainment, SM Entertainment, and Kakao VX.

• Focus on Core Assets: Kakao will retain strategic assets such as KakaoTalk, KakaoBank, and Kakao Piccoma, which are viewed as future growth drivers.

• Corporate Governance Overhaul: Since last year, Kakao has engaged external consulting and law firms to assist in improving its corporate governance.

• Public Opinion and Legal Challenges: The decision comes amid deteriorating public opinion and increased scrutiny due to frequent spin-off listings and ongoing investigations.

According to sources in the IT and investment banking sectors, Kakao has initiated the search for buyers for its subsidiaries. A Kakao official emphasized the company’s intention to sell everything except for its core assets, stating, “We decided to slim down due to deteriorating public opinion caused by various investigations.”

Kakao is progressing with asset sales by evaluating the equity relationships within the group. For example, the sale of Kakao VX, a golf brokerage platform, has been actively pursued since early this year. The company is also seeking a buyer for Ceragio Country Club, a public golf course it invested in. Kakao Games is expected to find a new owner after the sale of its subsidiary Kakao VX.

Additionally, Kakao Entertainment and SM Entertainment, which have increased Kim’s legal risks, plan to be sold after investigations are concluded. Kakao Pay is considering both external sales and increasing its ownership by having Kakao Bank or Kakao itself buy additional shares. However, Kakao has clarified that no specific decisions have been made regarding the sales policy.

Kakao and its competitor, Naver, are considered to be the leading growth stocks in South Korea. During the pandemic, liquidity surged, and Kakao’s stock price peaked at 169,500 won on June 23, 2021. However, consecutive spin-off listings of Kakao Bank and Kakao Pay led to negative public opinion, causing a decline in the stock price.

Allegations of market manipulation during the acquisition process of SM Entertainment and recent accusations against Kakao Mobility for violating accounting standards have fueled criticism both inside and outside the company.

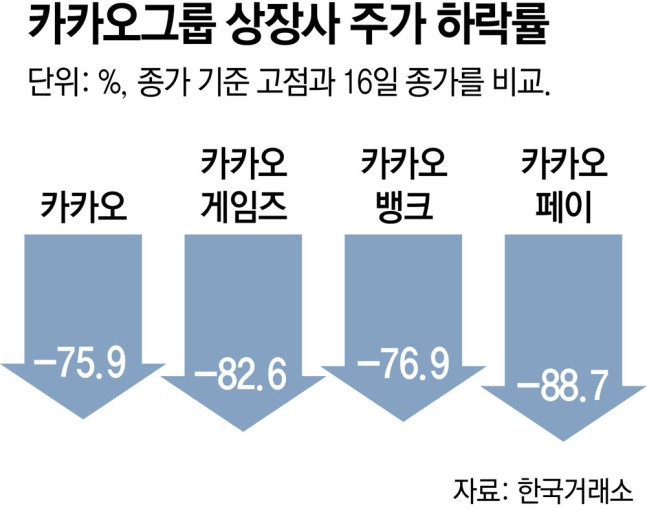

Despite Kim’s efforts to enhance responsible management by establishing the Compliance and Trust Committee at the end of last year, the lack of substantial progress led to further stock declines. As of the 16th, Kakao’s stock price had dropped to 40,900 won, down 75.9% from its peak. The stock prices of Kakao Pay (-88.7%), Kakao Bank (-76.9%), and Kakao Games (-82.6%) also fell by around 70-80% from their peaks.

An industry insider commented, “Although Kakao is improving its corporate governance by selling subsidiaries, external perceptions of responsible management remain cold. More concrete actions, such as personal investments by Chairman Kim to save the company, are needed.”

SHARE

SHARE