Big Hit Entertainment, with one of the most highly-anticipated IPO's, has started a general subscription for individual investors on October 5 KST.

On the first day, the subscription deposit for Big Hit's IPO was more than 8 trillion KRW (~6,910,642,400 USD), which is higher than SK Biopharm but lower than Kakao Games.

It was relatively quiet at the physical locations of the securities firms on the first day of subscription for the general public offering for Big Hit Entertainment.

This is because many investors who had applied for the public offering with SK Biopharm and Kakao Games used online subscription.

A subscription to an initial public offering is an order to purchase the shares at a set price once they are issued. Subscribers buy newly-issued shares directly from the company. Big Hit's offering price per share is 135,000 KRW (116.58 USD) with a competition ratio of 89.6 to 1. The subscription deposit alone exceeded 8.6 trillion KRW. This was more competition than SK Biopharm but half as much as Kakao Games.

Previously, Kakao Games had a competition rate of 1,524 to 1, and SK Biopharm had a competition ratio of 323 to 1.

Investors have to pay half of the subscription as a deposit. Therefore, the higher the competition, the smaller the number of shares they can actually receive.

As a result, many are interested in how much the final deposit will be and whether the company will be able to break the record that was previously set by Kakao Games on the second day.

At the same time, the stock market's target stock price for Big Hit Entertainment ranges from 160,000 KRW (~138 USD) to 380,000 KRW (~328 USD). Although, there is a positive outlook in terms of diversification of the business structure, there are some who point out that Big Hit Entertainment has been overvalued.

There have been cases where the stock prices have fallen after the first initial listing, therefore, there are some concerns that individuals should be wary of blind investments that are made based on the public offering craze.

SHARE

SHARE

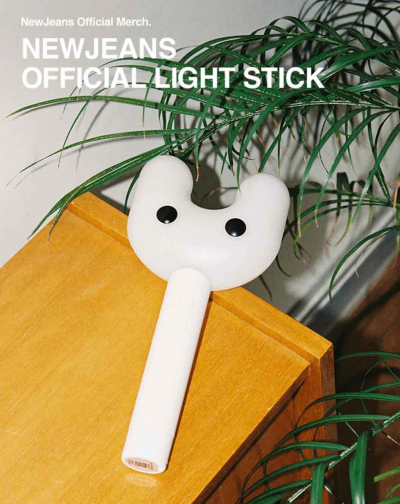

I think people often underestimate BigHit because they think they just depend on BTS when in reality BigHit was expecting this and they have been buying small labels and plan to expand even more. BigHit now gets a cut from BTS, Gfriend, TxT, N'uest, Seventeen, En-Hyphen and all of the future groups they personally debut as well as from their acquisitions, Pledis and SourceM. Moreover unlike other big companies, they created their own apps/platforms like Weverse because they invested in their own tech department, they no longer partner with anyone (I.e Naver's Vlive), so they get a 100% of the online concerts and merch sold. They are also bringing in artists from other companies to Weverse, like CL and P1Harmony (FNC), so they get a percentage from them too.

1 more reply